The move to electric power is now seen as one of the most viable ways the industrialized world can reduce its greenhouse gas emissions, in order to tackle the issue of climate change. The long-term goal is climate neutrality, which will see a net zero change in the amount of carbon in the atmosphere. The Paris Agreement is seen as a step in that direction, and the move to electric vehicles is a significant part of the plan.

Many nations now have in place aggressive targets to see the complete abolishment of internal combustion engines (ICEs) powering road vehicles. New vehicles will not be allowed to be powered by ICEs based on polluting fuels. This mostly impacts fossil fuels but, in theory, at least, extends to the combustion of any type of fuel that could emit greenhouse gases. That means motive power must come from another source and the most promising is electricity that is stored or generated cleanly, in the vehicle.

A global EV infrastructure

The electric vehicle industry is now advancing at a rapid pace. The demand for electric industrial vehicles is growing globally, partly through the orchestrated push towards electric but also thanks to increased consumer pull. This has a two-fold impact on global market conditions. Firstly, it is motivating the public sector to invest in the EV industry and, secondly, it is encouraging the private sector to enter the market with new products.

According to global research conducted by Deloitte, the three most commonly cited concerns related to the adoption of electric vehicles/electric industrial vehicles are range, cost, and access to EV charging stations. The EV charging infrastructure is largely the responsibility of the public sector, even if that is subsequently outsourced to private companies. The issue of range and cost are predominantly under the control of the vehicle manufacturer.

The EV infrastructure in the U.S. is expected to grow by almost 40% per year over the next decade. In Europe, the EU’s member states demonstrate demand for public charging stations for electric vehicles at somewhere between 4 vehicles per charge point (Netherlands) and 10 (Greece, Sweden, and Finland), while others are over 10 cars per charge point. What is also clear is that the number of EVs in use in Europe is currently growing at a faster rate than the infrastructure, but this is not deterring consumers.

The infrastructure to support this move to EVs is also global. Manufacturers are seeking out partners to help them bring new vehicles to market. The E–mobility ecosystem is expanding most rapidly in regions that are encouraging most strongly the move to electrification in road vehicles.

For example, in India, more than 2,600 charging stations will be installed in more than 60 cities and 24 states. This is happening under Phase II of the FAME (Faster Adoption and Manufacturing of Electric Vehicles in India) scheme. The goal is to have at least one public charging station for electric vehicles in every 4km square area in most cities. The India Energy Storage Alliance (IESA) predicts this to generate growth in the medium-speed electric 2-wheel vehicle class (up to 40 kmph) of 79% CAGR through 2025.

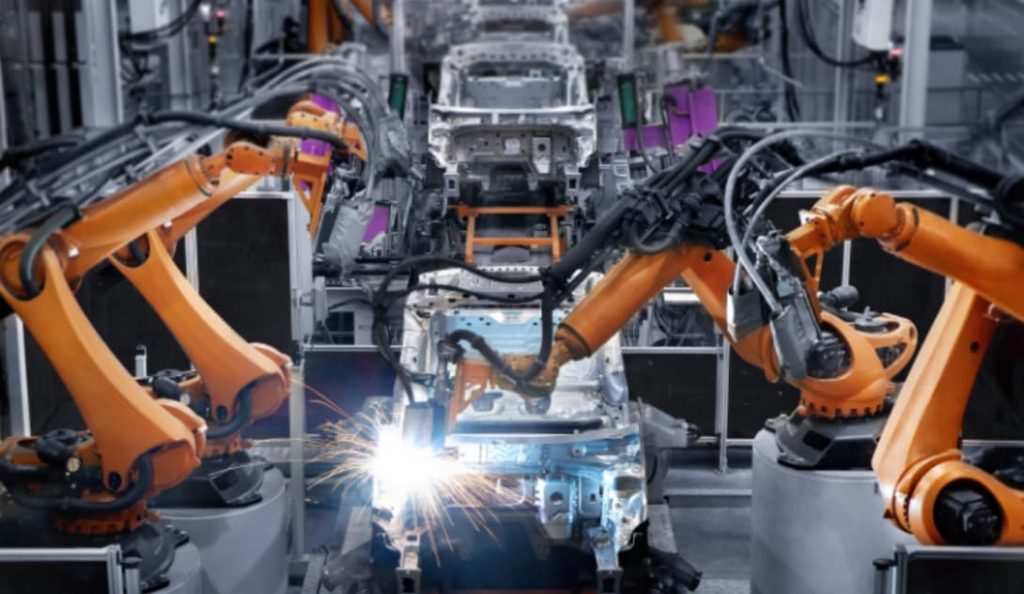

This growth cannot happen without the engineering ecosystem to support it, and that includes design and manufacturing support from service providers. A large part of the growth in demand will be met by start-ups; companies that are new to the EV landscape but, also, often new to the automotive sector in general.

There is a growing ecosystem of companies offering design and manufacturing as a service to these start-ups and other automotive companies moving into the EV market. This presents both opportunities and challenges. Most obviously, the opportunities are related to the very large market and growing demand for EVs. The challenges relate to the market dynamics that exist in all sectors but most prominently in the electric vehicle market.

Global EV market dynamics

Entrants into a new market can expect to experience a period of growth that offers larger margins. Most products will see an erosion of selling price and, consequently, profit margin, over time. This is an important dynamic in global commerce because it allows the relatively higher selling price paid by early adopters to help encourage and sustain the early growth of a new market.

While electric vehicles can still be considered to be a new market, the same dynamics are not present. As mentioned earlier, one of the top three concerns given for not moving to an electric vehicle is cost. There is no denying that EVs carry a premium price, and this has an impact on consumer buying. Unlike other new markets, manufacturers cannot expect to charge a premium for their products, they must be competitively priced from the introduction.

This compounds the challenge for start-up companies’ e-mobility ecosystem that is not established brands in the market. Often, they may need to compete on price more aggressively than they would in other markets. As a consequence, the cost of every component in the vehicle is crucial to the bottom line.

For start-ups, this can present a particular challenge. They may have the engineering expertise needed to design, develop and prototype the key elements of an electric vehicle, but they may lack the experience and supply chain to move that design into production while securing the very best price for the components used. They may also appreciate that some of the systems are differentiating but not within their own skillset. This is where working with the right partner in the right location and a strong ecosystem can help.

India is emerging as a low-cost manufacturing center for EV design and manufacture. The local ecosystem is growing in response to government investment. This has generated a community of expertise that is now accessible to the world’s markets. More and more manufacturers are choosing to outsource their EV needs to India. This is creating a virtuous cycle of reinvestment and expansion that is driving down the cost of manufacturing more aggressively than in other regions.

Building better EVs

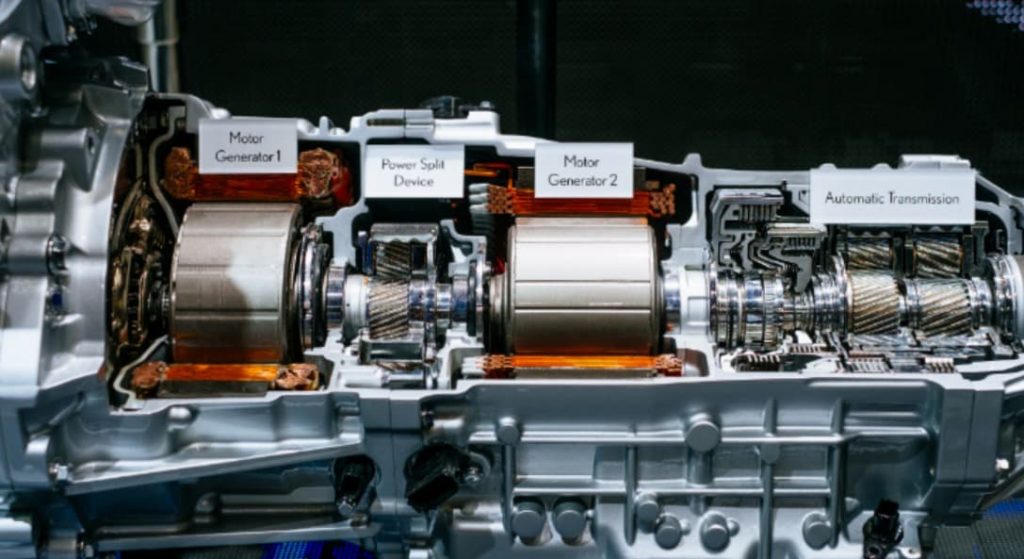

Of all the key systems in an Electric Vehicle, the Powertrain and Energy Systems are the most crucial. Powertrain refers to the sub-systems and components that provide and manage the power required to move the vehicle. As a general comparison, the Powertrain and Energy Systems in an EV contain 60% fewer components than the comparable systems in an ICE vehicle and represent around 70% of the total cost. The main sub-systems of an EV Powertrain comprise the Electric Motor, the Motor Controller, and the E-Throttle. The Energy System comprises the Battery Pack, Battery Management System for Electric Vehicle, and the On-Board Charger. The rest of the system is provided by key components, including the DC-DC converter, switches, the chassis, and the wiring harness.

India is well advanced in the area of Brushless DC (BLDC) and Permanent Magnet Synchronous Motor (PMSM) design and manufacture. This includes designing the housing, motor casing, wirings and harnesses, rotors, and stators, particularly for the 2-wheel and 3-wheel EV market. All of these parts and their components are manufactured in India, by a number of market leaders. This ecosystem employs large teams of engineers with expertise in the design and manufacture of electric motors and motor control systems, based on the latest automotive-compliant integrated solutions. This includes microcontrollers from the world’s leading semiconductor manufacturing companies that are designed specifically for automotive motor control applications.

All of the main components in the Energy System are sensitive to extreme weather conditions, which includes the battery pack and battery management system (BMS). Manufacturers in India have invested heavily in researching this area and have worked rigorously to design and calibrate battery packs that can function reliably in all of the extreme temperature conditions found in various geographical regions across India. All countries across Europe and Africa can now benefit from the expertise developed through products developed by Indian companies. India’s leading design and manufacturing providers invest in the most advanced environmental testing facilities in order to provide this level of assurance. Other key elements in an EV Energy System are the DC-DC converters and DC- AC inverters needed to drive the BLDC/PMS motors. This covers the optimized design of power converters, using various topologies, based on the latest technologies such as wide bandgap power transistors and integrated power modules from leading suppliers.

Experienced companies within India’s EV ecosystem are partnering with start-ups and established automotive companies working on EVs. They can offer advice on best- practices in this area. By working within this ecosystem and drawing on the expertise of established design and manufacturing service providers for global mobility technology, EV manufacturers can expect to save between 30% and as much as 60% on the cost of components and sub-systems.

EVs for a green revolution

Global economics and the COVID-19 pandemic have distorted the curve for EV adoption, with 2019 seeing a decline year-on-year. However, the entire industry agrees that this is a temporary disturbance and sales figures started to recover in 2020.

Major incentives may be extended to compensate for this setback. This means the future of mobility and solutions we can expect the global market for electric vehicles to continue to grow. In the decade between 2010 and 2019, the total number of electric vehicles on the world’s roads grew from almost zero to over 7 million. The year-on-year growth rate is climbing and is anticipated to reach 2 million per year in the coming years.

This all points to the future of mobility – a greener future, with fewer pollutants being introduced into the atmosphere from road vehicles. Indeed, many countries now have a zero-emission directive for their road vehicles. India’s government has committed to the Paris Agreement and signed the United Nations Framework Convention on Climate Change Accord, to help reduce global greenhouse gas emissions. The government’s goal of all road vehicles being EVs by 2030 is extremely ambitious, and the development of the EV ecosystem is fundamental to meeting it. That same ecosystem is now available to the world’s EV manufacturers.

In combination, there are efforts to introduce vehicles powered by alternate fuels to India’s roads. This has encouraged various companies to focus their resources on the design and development of EV components and vehicles. Napino is one of those companies, earning its position as a leading company in the design, development, and manufacturing of EV components for Electric vehicles in India.

Backed by its strong and dedicated teams of engineers, testing facilities, and validation laboratories, Napino is ideally positioned to provide the support for Powertrain and Energy Systems needed by OEMs across the global EV market.